The Founder’s Guide to Key Startup Metrics(With Formulas)

The time when all it took to raise money was some gusto and a smile is gone for the time being. If you, as a founder, want your startup to not just survive, but thrive, in this bear market, you need to be ready with the numbers that validate your business model and product fit.

Today, we’re going to explain and calculate 6 key metrics that you should know for your startup: Customer Acquisition Cost(CAC), Customer Lifetime Value(CLV), Churn, Burn Rates, and Total Addressable Market(TAM)

Let’s get started

- Customer Acquisition Cost

Customer Acquisition Cost(CAC) measures how much it costs to acquire a singular customer. There are two ways to measure it: Blended CAC and Paid CAC, you’re likely going to want to be able to give both to investors.

Blended CAC is the more general formula. It is calculated by taking marketing spend over a period of time and dividing it by the amount of new users during that time period.

Paid CAC is the acquisition cost excluding organically acquired users. This measures exclusively how effective your paid marketing channels are. It is calculated by taking marketing spend over a period of time and dividing it by the number of users acquired during that time period through paid channels.

Additionally, you should also be able to calculate the Paid CAC for particular marketing and sales channels that you use. This can help you prioritize what channels to utilize.

Example:

Let’s say in 2021 our startup:

- Spent $20,000 on total marketing efforts

- $10,000 on Paid Search

- $5,000 on Conferences

- Acquired 100,000 users

- 60,000 through paid channels

- 25,000 from Paid Search

- 3000 from Conferences

This would give us the following CAC’s:

- Blended CAC: $20,000 / 100,000 users = $0.20/user

- Paid Cac: $20,000 / 60,000 users = $0.33/user

- Paid Search CAC: $10,000 / 25,000 users = $0.4/user

- Conferences CAC: $5,000 / 3000 users = $1.67/user

2. Customer Lifetime Value

Customer Lifetime Value(CLV) is an estimate of the present value of the projected future revenue from a customer over the entire lifespan of your relationship with them. In plain english, it is the total amount of money that you get from the average customer throughout the entire span of your relationship with them.

Unlike CAC, this can be much more difficult to calculate. CLV might be asked for in nominal or real terms, and ideally should be split up by different segments of your user base(Just like CAC).

The easiest way to calculate CLV is to find the average lifespan of a customer(How long they do business with us) and the average amount of time that a customer spends per unit of time. The average lifespan is equal to the reciprocal of the churn rate(more on that later).

If we are working with nominal CLV, then all it takes is multiplying these two numbers together.

If we are calculating real CLV, then we need to factor in a discount rate. This is a more complex topic than this discussion warrants, but the general idea is that when talking about money we will be receiving in the future, we need to factor in the value lost since we are receiving it later on.

For example, having $100 now is better than having $100 10 years from now, because if I had the money today I could buy $100 worth of bonds and be guaranteed even more money a decade from now.

Example #1(Nominal):

- On average, a customer stays with us for 2.5 years(30 months)

- The average customer spends $20/month

Based on those numbers, the nominal CLV: 30 months * $20/month = $600

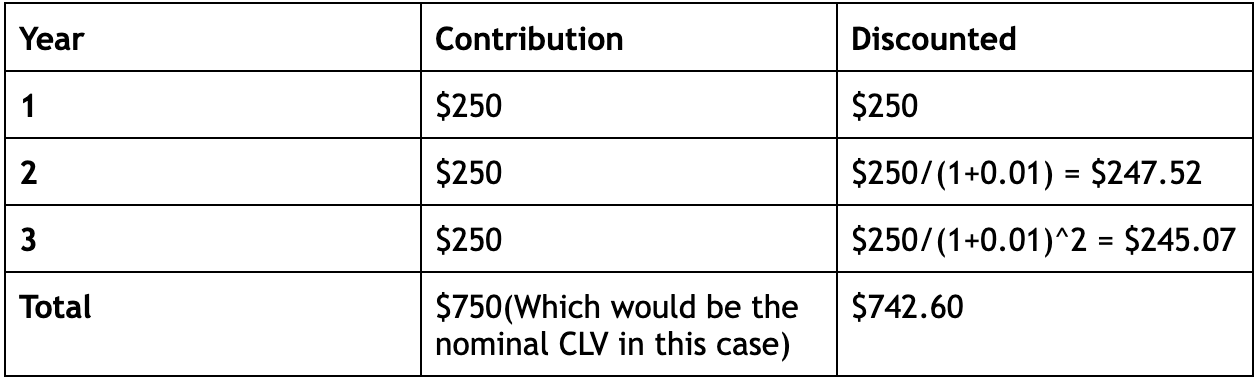

Example #2(Real):

I’m going to do everything in terms of years to make this simpler

- On average, a customer stays for 3 years.

- On average, a customer spends $250/year

- The discount rate(The guaranteed rate of return if we instead bought treasury bonds) is 1%.

So our real Customer Lifetime Value is $742.60

Depending on what your product is, you might have distinct groups of customers that you want to calculate lifetime value for. Additionally, if you have data on the rate that customers refer new customers, you can factor that into your CLV(Drop a comment or shoot us an email if you want an explainer on that).

The validity of your business is based on the ratio between your CLV and CAC. Obviously, if your acquisition cost is greater than the value each customer is bringing, your business model simply is not sustainable.

The higher your CLV:CAC the more opportunity there is for profit, and the stronger your business model is.

3. Total Addressable Market(TAM)

The other key component to validate your startup’s business model is the Total Addressable Market(TAM). This is the total amount of possible revenue that your company could acquire, based on the size of the markets that you meet.

Note the word possible here is very ambiguous. It’s very common for founders to overstate their TAM and not get taken seriously as a result. A common way to break this issue down is into three submetrics: Total Addressable Market(TAM), Serviceable Available Market(SAM), Serviceable Obtainable Market(SOM).

Total Addressable Market is the total size of the market you are concerned with.

Serviceable Available Market is the total size of the portion of the market that would benefit from your services.

Serviceable Obtainable Market is the portion of the market that you could realistically obtain given existing competition.

Having these numbers on hand can prove that your startup has room to scale

Example:

Let’s say we are building a digital ordering kiosk for restaurants. Our TAM might be the size of the entire restaurant industry.

However, many restaurants are sit-down and will always prefer to use waiters. Additionally, many restaurants don’t need digital kiosks because they don’t get enough traffic. Thus our SAM is the portion of the restaurant industry that is not upscale/sit-down and have sufficient traffic to warrant getting a digital kiosk.

But let’s say that all major fast food chains build their own kiosk systems. Additionally, let’s say there is a competitor who has already captured the entire west coast, but the rest of the country is currently un-served. Thus our SOM would be the portion of our SAM that is not part of a major chain and is not on the west coast.

Now let’s get to the simpler ones:

4. Customer Churn(and Retention) Rate

The Customer Churn rate is the percentage of customers that leave in a given time period. It is calculated by taking the amount of customers that leave in a time frame and dividing it by the amount of customers that were there at the beginning of the time frame.

Similarly the Customer Retention Rate is the percentage of customers that are still customers at the end of a time frame. Thus we get that Churn % + Retention % = 100%

Additionally, the customer lifespan is the average amount of time that a customer continues to do business with you. It can be calculated by dividing 1 by the churn rate.

These numbers all show how sticky your product is, and are one of the key ways to measure product market fit.

Example:

- Started 2021 with 100,000 users

- Of those 100,000 users, 80,000 were still using the product by the end of the year

Given those numbers:

- Customer Retention Rate: 80,000/100,000 = 80%

- Customer Churn Rate: 20,000/100,000 = 20%

- Customer Lifespan: 1 / 0.2 = 5 years

5. Revenue Churn(and Retention) Rate

The Revenue Churn Rate is the percentage of your contracts that you lose over a period of time in terms of dollars. Unlike Customer Churn, this can be positive or negative, and is thus a great measure of how well of a value exchange you are doing with your customers.

This is calculated by taking all the customers that are paying at the start of the time period, and then finding the difference between the amount they are spending by the end by the amount they spend at the beginning. We then divide that difference by the amount they were spending at the beginning

Much like customer churn, we can calculate the revenue retention rate as just the amount they are spending at the end divided by the amount they are spending at the beginning. Additionally, Revenue Churn % + Revenue Retention % = 100%.

Unlike customer churn, revenue churn can also be positive if a lot of your customers increase the amount they are spending over the time period.

Example:

Let’s say we have:

- 40 customers at the beginning of 2021

- 20 pay $400/year

- 20 pay $200/year

- Of those 40 customers, these are their subscriptions for 2022:

- 25 pay $400/year

- 5 pay $200/year

- 10 are no longer doing business

So this means,

- Our revenue at the beginning of the year was 400*20 + 200*20 = $12,000

- Our revenue for 2022 from those customers was 400*25 + 200*5 = $11,000

- Our revenue lost from those customers after a year was $12,000 - $11,000 = $1000

- Thus our Revenue Churn Rate is $1000/$12,000 = 8.3%

- Our Retention rate is $11,000/$12,000 = 91.7%

Those are the main 5 metrics that every founder should sit down to calculate. They’re not only important to be able to give to investors, but to also see if your business is on the right track so that you can correct it if something is wrong.

Additionally, breaking these metrics down by customer segment is one of the best ways to find underserved markets and weak points in your strategy.